A Q&A with Hunting Dog’s Leadership Team

Like our name, we are diligent, disciplined and tenacious when it comes to achieving our investment objectives. We are committed as acting fiduciaries of our clients’ capital to aligning interests...

View

Like our name, we are diligent, disciplined and tenacious when it comes to achieving our investment objectives. We are committed as acting fiduciaries of our clients’ capital to aligning interests...

View

Hunting Dog Capital is pleased to announce that its portfolio company, Pet Brands, a leading provider of health and wellness solutions for dogs and cats in the treat and consumable categories, has...

View

Hunting Dog Capital is pleased to announce that it has completed its exit from its senior term loan with warrants to Danimer Scientific (ticker: DNMR). Headquartered in Bainbridge, GA, Danimer...

View

Hunting Dog Capital is pleased to announce the completion of the first phase of the upgrade and expansion program for its portfolio company, Clean Water Environmental...

View

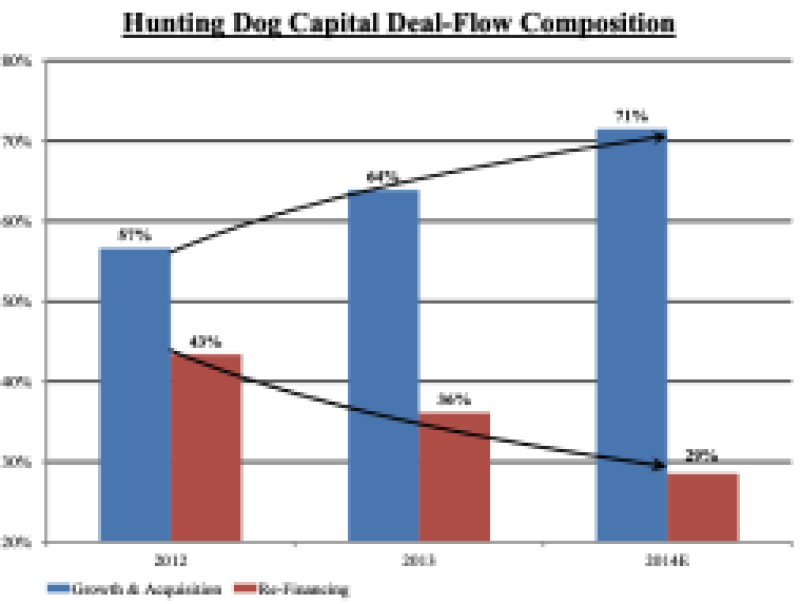

We started Hunting Dog Capital in 2006 with the vision of creating an investment vehicle that could deliver solid, risk-adjusted returns to investors by providing growth capital to smaller...

View

We started Hunting Dog Capital in 2006 with the vision of creating an investment vehicle that could deliver solid, risk-adjusted returns to investors by providing growth capital to smaller US...

View

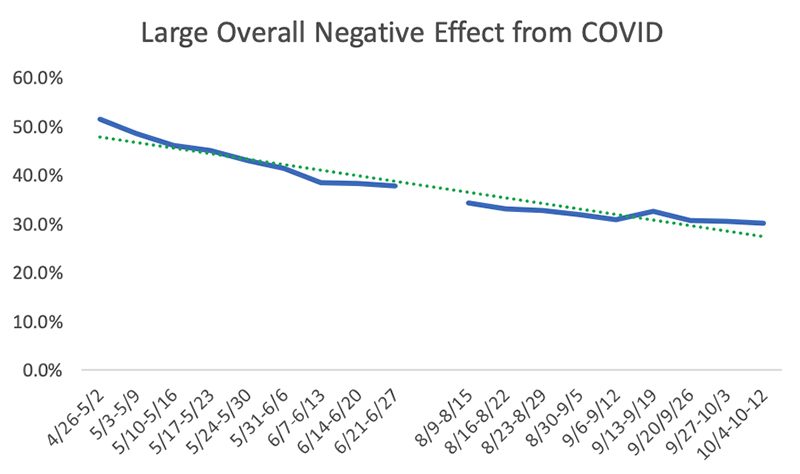

When hunting for new lending opportunities, we are continually amazed by the resourcefulness and creativity of lower, middle-market companies to adapt and thrive in today’s challenging environment....

View

Hunting Dog Capital has been a lender to lower middle market companies since 2004. From experience, we have learned that borrowers operating to plan is not the norm. Even with the most detailed...

View

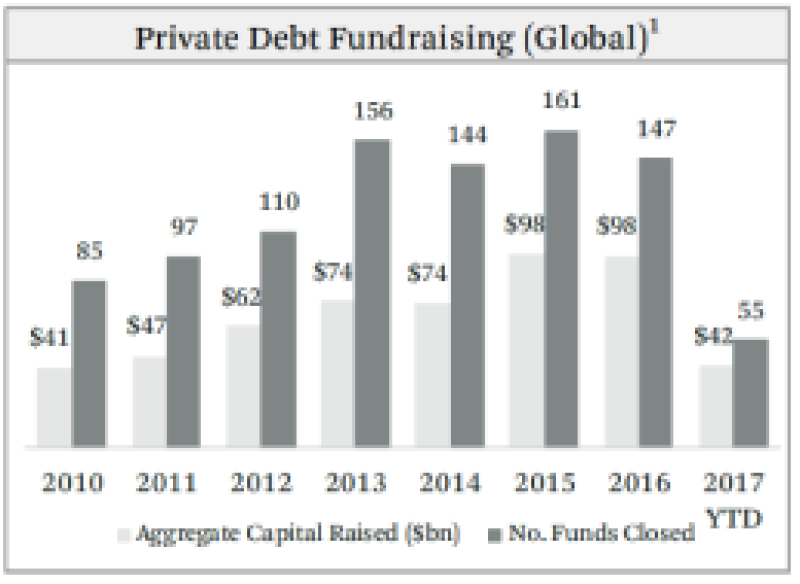

Our Q3:2017 white paper analyzes the growth in private debt fundraising and the relatively limited institutional focus on the lower middle-market, which limits competition and pricing pressure,...

View

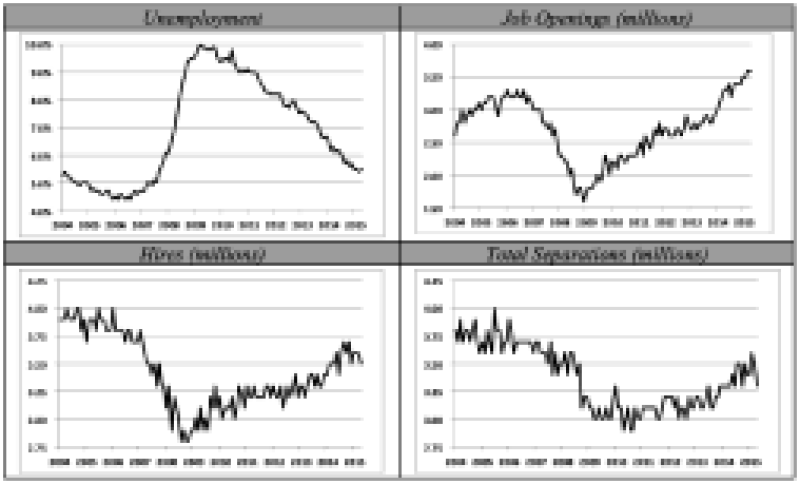

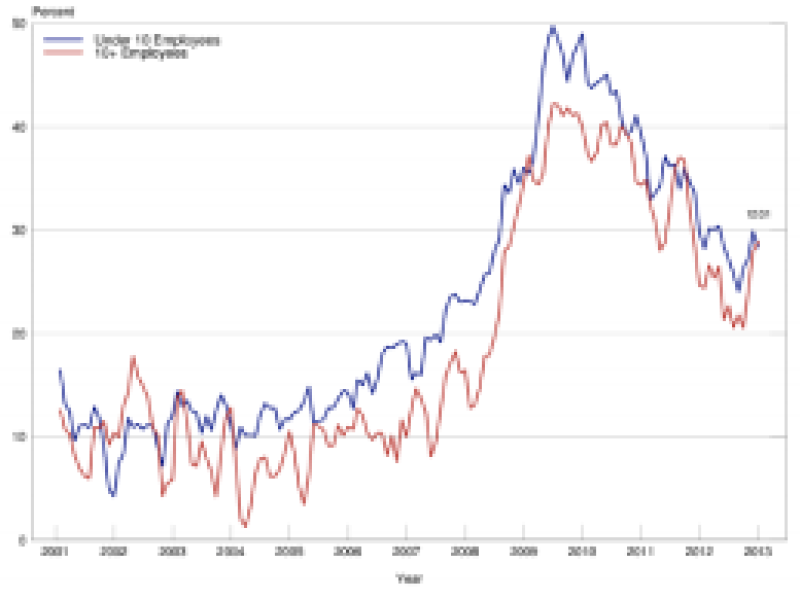

The select statistics we review in this paper – hiring, capital expenditures and inventory trends – suggest business owners continue to invest in their businesses to maintain and oftentimes expand...

View

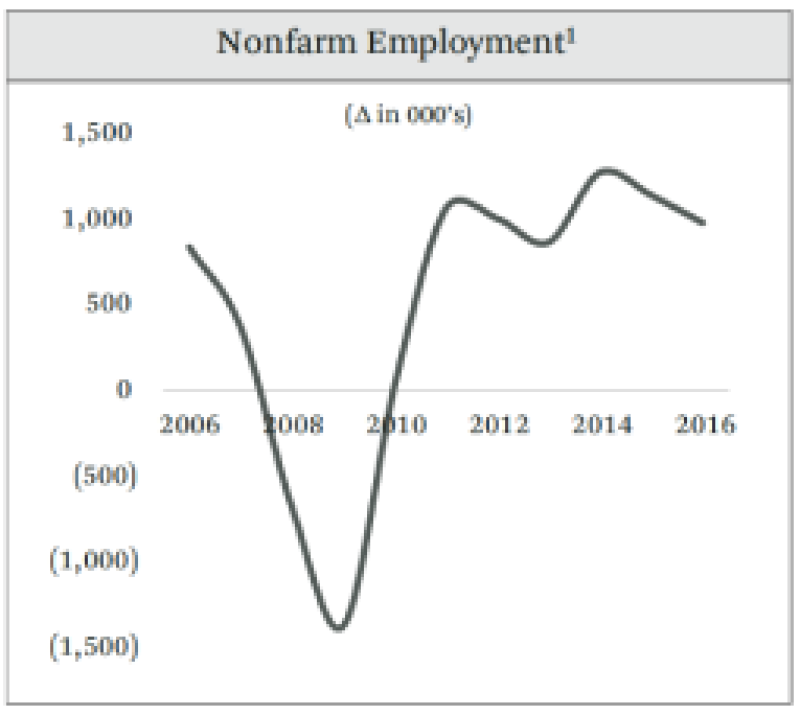

We share our observations on employment trends — specifically those of the lower middle-market — and how those trends might impact the broader lower middle-market community, from debt and equity...

View

While some recent articles suggest that access to capital has returned to pre-2008 conditions, we believe that this is not the case for many lower middle-market companies.

View

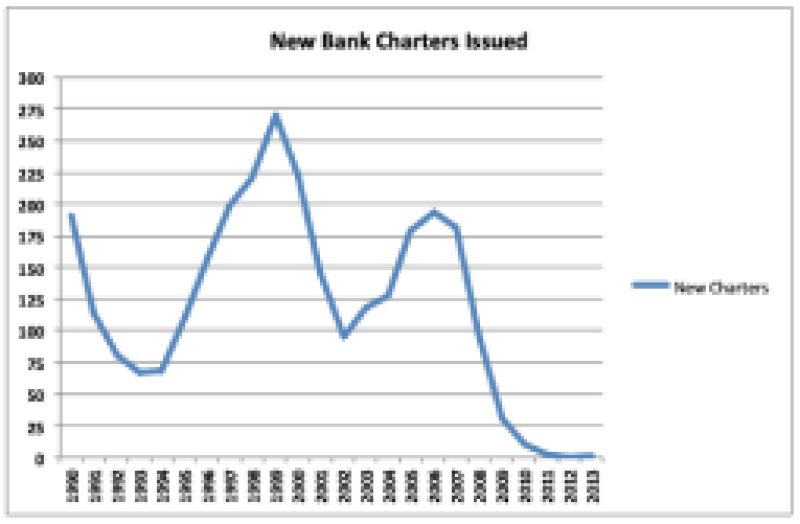

Traditional commercial banks have significantly restricted credit relative to pre-2008/2009 credit crisis levels, and are consequently losing ground quickly in lower-middle market lending.

View

According to the Federal Deposit Insurance Corporation (“FDIC”), the number of federally-insured banks dipped to 6,891 during 2013, which is the lowest level since 1934 when the government began...

View